On December 31, 2025, Korean outlet Newsis published something that made every PC gamer's stomach drop: the RTX 5090—already $1,999 at launch—could hit $5,000 by year's end. A 150% spike in twelve months.

Your first instinct is to blame "supply chains" or "memory shortages." That's what Nvidia wants you to think.

I spent three weeks tracking congressional trading disclosures, reading federal procurement contracts, and cross-referencing memory manufacturer earnings calls. What I found isn't a story about market forces or temporary disruptions.

It's a perfectly legal extraction where taxpayer money built the infrastructure, politicians traded on insider access, memory manufacturers weaponized artificial scarcity, and Nvidia became the toll collector standing between you and a functioning gaming PC.

This isn't illegal. That's what makes it worse.

(This is an editorial analysis based on public earnings calls, SEC filings, federal contracts, and congressional trading disclosures. The conclusions are my own.)

The $5,000 GPU That Nobody Can Explain Away

Multiple sources now confirm coordinated price increases starting January-February 2026:

- Tech4Gamers (citing Newsis): RTX 5090 prices climbing to $5,000 by end of 2026

- Insider Gaming: "Both companies are reportedly planning to continue raising GPU prices every month going forward"

- Wccftech: Increases affect "the entire product lineup, encompassing not only consumer GPUs but also GPUs for AI data centers"

- TechSpot: ASUS announced strategic price adjustments for DDR5 and SSDs beginning January 5, 2026

The excuse they're giving? Memory costs.

An industry insider quoted by Newsis claimed memory now exceeds 80% of GPU manufacturing costs. DDR5 16GB chips jumped from $5.50 in May 2025 to $20 in November. GDDR7 memory—what the RTX 5090 uses—is worse.

Here's the part they're not saying: Nvidia is telling board partners to source their own VRAM because Nvidia can't (or won't) secure enough supply. The RTX 5060 Ti 16GB is being discontinued entirely because "memory costs make it unprofitable."

Is the $5,000 claim sensationalist? Maybe. Will every RTX 5090 literally hit five grand? Probably not uniformly.

But memory scarcity isn't natural shortage. It's weaponized. And Nvidia benefits massively—it gives them pricing power while crushing AMD and Intel, who can't secure memory supply either.

What this means: When manufacturers discontinue mid-range products because they're "unprofitable" during record-breaking revenue quarters, that's not economics. That's strategy disguised as necessity.

And this isn't new. The RTX 4090 launched at $1,599 in October 2022. Within days, eBay scalpers were selling it for $4,000+. In February 2024, U.S. export controls caused 60% markups in Asian markets—resellers buying cards at $2,500+ to flip them into China at triple MSRP. Some buyers purchased entire $4,500 desktop PCs just to extract the GPUs.

Different generation, same pattern: scarcity—real or manufactured—becomes profit.

How U.S. Taxpayers Built This (Without Knowing It)

Everyone says "Nvidia didn't get direct government funding."

That's technically true and practically meaningless.

What the public record actually shows:

Direct DARPA Contracts to Nvidia

- $25 million – UHPC (Ubiquitous High Performance Computing) program, 2010

- $20 million – PERFECT program (Power Efficiency Revolution For Embedded Computing Technologies), 2012

- Additional contracts for CRAFT and other programs (amounts not fully disclosed)

DOE FastForward & Exascale Programs

- FastForward 1: $62.5 million total (five companies including Nvidia)

- FastForward 2: $99.2 million total (five companies including Nvidia)

- PathForward: $258 million over three years (six companies including Nvidia)

- DesignForward: $25.4 million for interconnect research

Nvidia's exact share isn't always disclosed, but they were major recipients.

DOE Supercomputer Contracts

- Summit at Oak Ridge National Lab

- Nine new DOE supercomputers announced October 2025: "more than $1 billion in public-private investment"

Conservative estimates put direct and indirect DARPA/DOE funding to Nvidia-involved programs at over $500 million in traceable contracts. Add NSF grants for university GPU clusters, DOE lab procurement, and CHIPS Act supplier subsidies, and taxpayers underwrote billions in Nvidia's ecosystem development.

Then Nvidia turns around and charges those same taxpayers $2,000-5,000 for GPUs built on publicly-funded research.

The pattern: The government didn't just fund Nvidia's R&D—they created the market, trained the workforce, and guaranteed the demand. Nvidia just slapped a price tag on it.

The CUDA Lock-In Nobody Noticed

Here's what actually happened with that taxpayer money:

Universities trained engineers on CUDA (Nvidia's proprietary software). National labs standardized on Nvidia GPUs. AI frameworks like PyTorch and TensorFlow optimized for Nvidia first—because that's where the publicly-funded compute clusters were.

By the time anyone realized what was happening, CUDA was the academic default.

The procurement language sealed it. Federal contracts for supercomputers often require specs that functionally mean "only Nvidia qualifies":

- "Must support CUDA"

- "Must run framework X efficiently"

- "Must meet benchmark Y"

Notice what's missing? Any mention of vendor neutrality.

Federal agencies—DOE labs, DoD simulations, climate modeling—spend $1-3 billion per year on systems containing Nvidia GPUs. That's not charity. That's guaranteed demand that private customers have to compete against.

The CHIPS Act ($52B + $75B in Tax Credits)

Nvidia didn't get CHIPS Act money directly. But every supplier Nvidia depends on did:

- TSMC (fabrication)

- SK Hynix (HBM memory)

- Samsung (packaging)

When the U.S. secures Nvidia's supply chain with subsidies, that's indirect support worth tens of billions in risk reduction. Nvidia doesn't have to worry about fab capacity or memory supply constraints—the government already de-risked it.

Export Controls = Invisible Protection

When the U.S. restricts advanced GPUs to China, it:

- Slows Chinese GPU competitors

- Reduces price competition

- Preserves Nvidia's margins

This isn't cash. This is policy-created profit worth hundreds of billions in preserved market value.

Read that again: The U.S. didn't write Nvidia a check. The U.S. engineered the environment where Nvidia couldn't realistically lose. And the people who engineered it? They're trading Nvidia stock.

Nancy Pelosi's Nvidia Trades (Or: Legalized Insider Trading)

Here's where "legal but unethical" becomes crystal clear.

The Timeline

November 2023: Paul Pelosi (Nancy's husband) buys 50 call options for Nvidia stock, $120 strike price, expiring December 20, 2024. Transaction value: $1-5 million.

July 2022: Before that, Paul Pelosi sold 25,000 Nvidia shares at a $341,000 loss—right before the CHIPS Act vote, which Nancy publicly supported and which directly benefits Nvidia.

The timing was so suspicious that the disclosure appeared one day later (Pelosi usually takes weeks), included a rare comment in the filing, and prompted Congresstrading.com's founder to note: "She wanted the public to know she cleared the books of this conflict of interest immediately."

December 2024: Paul Pelosi exercises 500 call options (50,000 shares) at $12 strike price. Value: $500K-$1M.

January 2025: Pelosi discloses purchasing 50 call options at $80 strike, expiring January 2026. Value: $250K-$500K.

December 31, 2024: Pelosi sells 10,000 Nvidia shares. Value: $1M-$5M.

When Yahoo Finance covered the 2023 trades, they noted Pelosi disclosed the purchase "on the Friday before Christmas weekend to avoid media coverage."

That's not disclosure. That's theater. You hide Christmas weekend trades because you know how they look. The timing tells you everything the filings don't.

Nancy Pelosi (or her husband—legally it doesn't matter, disclosed as household assets) made millions trading Nvidia stock while:

- Leading passage of the CHIPS Act that benefits Nvidia

- Sitting on committees that regulate tech

- Having access to classified briefings about China export restrictions

Is it illegal? No. The STOCK Act only bans trading on non-public information.

Is it ethical? Absolutely not.

The uncomfortable truth: Nancy Pelosi built the road, collected the toll, and invested in the traffic. The STOCK Act wasn't designed to stop this. It was designed to make it look like they tried.

She's Not Alone

Other members of Congress trading Nvidia stock (per Capitol Trades, Quiver Quantitative, Nasdaq):

- Rep. Michael Guest (R-MS)

- Rep. Josh Gottheimer (D-NJ)

- Rep. Gilbert Ray Cisneros Jr. (D-CA)

- Rep. Cleo Fields (D-LA)

Senator Josh Hawley introduced the PELOSI Act (Preventing Elected Leaders from Owning Securities and Investments) in January 2023 specifically because of this.

It failed. Because the people who would have to vote for it are the ones profiting from it.

The Memory Game (Or: How AI Ate Your GPU Budget)

Why is memory suddenly 80% of GPU cost?

Not because memory got harder to make. Because memory manufacturers—Samsung, SK Hynix, Micron—are prioritizing AI data centers over consumer products.

The Economics

- HBM (High Bandwidth Memory) for AI chips: $1,000 per unit

- Consumer GDDR7 module: $30-40 wholesale

That's a 25-30x price difference.

When OpenAI, Microsoft, and Google are building data centers requiring thousands of AI accelerators (each needing multiple HBM stacks), why would Samsung prioritize gamers?

Micron made this explicit in December 2025: They're discontinuing the Crucial consumer brand to "improve supply and support for our larger, strategic customers."

What they said: "Improve supply and support for our larger, strategic customers."

Translation: "Gamers aren't strategic customers. AI companies are."

Micron built its consumer brand on PC enthusiasts. When bigger buyers showed up, they killed Crucial. Not sold—killed. That's how much you matter to them now.

The Stargate Project

Announced January 2025 by OpenAI, SoftBank, and Oracle: $500 billion over 4 years in AI infrastructure.

OpenAI's total infrastructure commitments reportedly approach $1.4 trillion.

That's one trillion dollars competing for the same memory supply that feeds consumer PCs.

When TechSpot reports that "some high-end server memory kits now cost more than luxury SUVs," that's not a supply chain hiccup. You're competing against $1.4 trillion in committed AI spending. And you're losing.

Nvidia's Strategic Position

Nvidia benefits from memory scarcity because:

- It drives up GPU prices (more revenue per unit)

- It crushes competition (AMD and Intel can't secure supply either)

- It forces customers into multi-year contracts (data centers lock in supply)

Think about Nvidia's product strategy: The RTX 4060 Ti launched in 2023 with a gimped 128-bit memory bus—half the bandwidth of its predecessor, the RTX 3060 Ti.

Reviewers called it a "scandal" because the card couldn't handle 1440p gaming despite being marketed for it.

Nvidia's excuse? "We added more L2 cache to compensate."

Benchmarks proved that wasn't true—the card barely outperformed its predecessor and sometimes performed worse. Then Nvidia released a 16GB version with the same crippled bus, charging more for VRAM the card couldn't effectively use.

The reality: That wasn't engineering constraints. That was deliberately selling a hobbled product while marketing it as an upgrade.

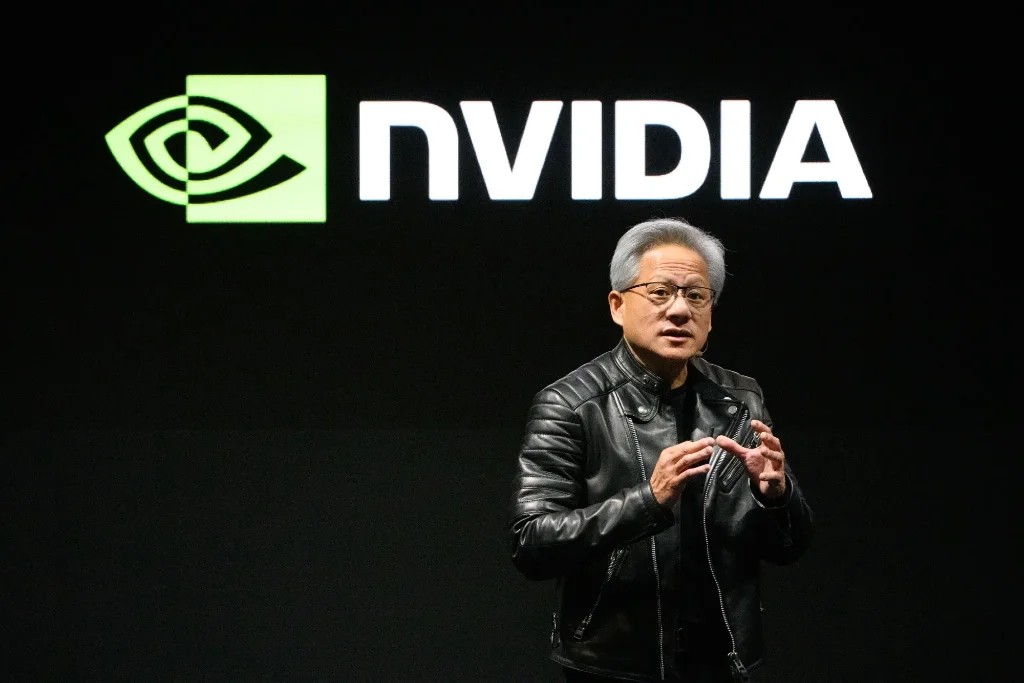

The Leather Jacket CEO and the $3 Trillion Company

Jensen Huang has been Nvidia's CEO since 1993. To his credit, he bet early on GPUs for compute, built CUDA before anyone cared, and positioned Nvidia perfectly for AI.

But here's what bothers me.

Jensen Huang's net worth: $152 billion as of December 2025. He completed a $1 billion stock sale in November 2025 alone—pre-planned, legal, timed perfectly as GPU prices started climbing again. He's sold over $2.9 billion in Nvidia stock since 2001. His fiscal 2024 compensation was $234 million. His first salary raise in a decade came in 2025—a 50% bump to $1.5 million base, plus $38.8 million in stock awards.

The man isn't struggling. He's cashing out while telling you graphics cards cost $2,000 because of "memory shortages."

Nvidia's Q3 FY2026 Revenue Breakdown

- Data center: 88% of total revenue

- Gaming: 7.5% of total revenue

Gamers are 7.5% of revenue. They used to be 100%.

Enthusiasts bought GeForce cards for decades. Now that AI customers pay 30x more, you're an afterthought.

And Nvidia's response? On their Q3 earnings call, CFO Colette Kress said:

"We have evolved over the past twenty-five years from a gaming GPU company to now an AI data center infrastructure company."

Decoded: "Gamers are legacy revenue. Data centers are the future. Price accordingly."

Not "we also serve data centers." We ARE a data center company.

Nvidia's market cap: ~$3 trillion (as of late 2025). That makes Nvidia one of the most valuable companies on Earth.

And Jensen Huang wears a leather jacket to keynotes like he's a rockstar, not the CEO of a company that just told gamers they're not the priority anymore.

The uncomfortable truth about Jensen Huang: he's brilliant at positioning, but the positioning was mostly luck. Nvidia bet on CUDA in 2006 when nobody cared about GPU compute. That bet paid off—not because Huang predicted AI, but because he made GPUs programmable and AI researchers happened to need programmable GPUs a decade later. Steve Jobs also wore black turtlenecks and positioned himself as a visionary. The difference is Jobs made products people loved. Huang makes products you can't avoid.

Historical Precedent: The GeForce Partner Program

Nvidia tried anti-competitive tactics before.

In 2018, they launched the GeForce Partner Program (GPP)—a scheme that forced manufacturers like ASUS and MSI to make their gaming brands (ROG, Gaming X) exclusive to Nvidia.

Want to use ROG branding on an AMD card? Tough luck.

HP and Dell refused to join, citing potential antitrust violations. The backlash was so severe—with calls for FTC investigation—that Nvidia killed the program after two months, claiming they were "battling misinformation."

Translation: they got caught trying to monopolize brand loyalty and backed down when regulators started paying attention.

Same company, same playbook—just smarter about hiding it now.

The Mining Crisis They Profited From

Remember 2021-2022? Cryptocurrency mining created a "GPU famine." RTX 30 series cards sold for three times MSRP on secondary markets. Gamers couldn't buy graphics cards for years.

Nvidia's response? The LHR (Lite Hash Rate) limiter—cards that supposedly cut mining efficiency in half.

Miners bypassed it within months. NiceHash unlocked 100% mining performance. The LHR was theater, not protection.

By October 2022, Nvidia quietly removed the limiter entirely. By then, the damage was done—and Nvidia had posted record revenue quarters while gamers paid scalper prices or waited years for availability.

Now it's happening again with AI—and this time, there's no crash coming to reset prices.

Antitrust Investigations (Yes, Plural)

Nvidia is currently under antitrust investigation in:

- United States (DOJ)

- European Union

- France

- United Kingdom

- China

The allegations: anti-competitive bundling, market manipulation in AI chips, and using dominance to disadvantage competitors.

Five countries investigating the same company for the same patterns. Call it "regulatory overreach" if you want. I call it a pattern regulators finally noticed.

The "Pressure Cooker" Culture

Huang's been praised as a visionary CEO who "tortures employees into greatness" instead of firing them—that's a real quote, by the way.

Employees work 70-80 hour weeks in what former staff describe as a "pressure cooker" with "fighting and shouting" in meetings. Low turnover (2.7%) isn't about culture—it's about stock grants that made employees millionaires.

Huang personally reviews all 42,000 employees' compensation monthly to ensure nobody leaves before their RSUs vest.

That's how you keep 42,000 employees loyal—not with culture, but with vesting schedules.

What Happens Next (Spoiler: It's Not Good)

Best Case Scenario

- AI spending moderates in 2026

- Memory supply stabilizes

- GPU prices plateau around $2,500-3,000 for high-end

- Lawmakers pass stock trading ban (unlikely)

Realistic Scenario

- AI race continues

- Memory stays expensive indefinitely

- RTX 5090 hits $3,000-4,000 (not $5,000 everywhere, but close)

- Budget gaming PCs become unaffordable

- Console gaming grows as PC gaming becomes luxury hobby

Worst Case Scenario

- Geopolitical crisis involving Taiwan (where TSMC is)

- Memory supply collapses entirely

- GPU availability craters

- RTX 5090 actually does hit $5,000 in some markets

And through all of this: Politicians will keep trading Nvidia stock. The U.S. government will keep funding the ecosystem. Nvidia will keep raising prices. And consumers will keep getting told this is just "market forces."

The Stuff Nobody Wants to Say Out Loud

Time to be blunt.

1. This isn't capitalism—it's state-backed monopoly

When taxpayers fund the research, the government secures the supply chain, export controls block competition, and politicians trade the stock... that's not a free market. That's a rigged game with legal paperwork.

2. The $5,000 RTX 5090 is a threat, not a prediction

Nvidia is testing how much the market will bear. If whales pay $5,000, that becomes the new normal. If sales crater, they'll "graciously" lower it to $3,500 and call it a deal.

3. Memory scarcity is weaponized, not accidental

Memory manufacturers could prioritize consumer products. They choose not to because AI customers pay more. Nvidia could push back. They don't because scarcity benefits them.

4. Politicians won't fix this

You can't ask the people profiting from the system to regulate the system. Nancy Pelosi made millions on Nvidia trades. You think she's going to support breaking up Nvidia's monopoly?

5. Gamers are expendable

Nvidia's CFO said it: they're a data center company now. Gamers are 7.5% of revenue. If gaming GPU sales drop 50%, it barely dents their bottom line.

We're not customers anymore. We're legacy revenue.

The Verdict

Nvidia didn't cheat. They played the game better than anyone else.

But the game was rigged from the start.

Taxpayers funded the research. The government secured the supply chain. Export controls blocked competition. Politicians traded the stock. Memory manufacturers weaponized scarcity.

And now a GPU that should cost $1,000 is heading toward $5,000 while the people who built the system cash out.

Is it legal? Yes.

Is it ethical? No.

Is it going to change? Not unless consumers force it.

Right now, most consumers don't realize what's happening. They just see prices going up and assume "that's inflation" or "supply chain issues."

It's not. It's a perfectly executed extraction of value from the bottom to the top, wrapped in legalese and disclosed in earnings calls nobody reads.

What You Can Do

Not much, honestly. The system's locked in.

But you can:

- Buy used hardware and skip this generation entirely

- Support AMD and Intel if they offer competitive alternatives

- Demand your representatives pass stock trading bans

- Call out this pattern loudly and repeatedly

Because if we normalize $5,000 GPUs, that's just the start.

Next it'll be $7,000. Then $10,000. Then gaming PCs become what sports cars are now—luxury items for the wealthy.

And Jensen Huang will keep wearing that leather jacket, cashing those checks, and telling us this is just how markets work.

And we paid for it.

Sources: Tech4Gamers/Newsis (December 31, 2025), Insider Gaming, Wccftech, TechSpot, Yahoo Finance congressional trading disclosures, Capitol Trades, Quiver Quantitative, Nasdaq congressional trading data, Nvidia Q3 FY2026 earnings call, Micron press releases, OpenAI Stargate Project announcements, federal procurement databases, CHIPS Act public records, DARPA contract disclosures, DOE FastForward/PathForward documentation