An Investigative Report

January 22, 2026

On January 21, Ubisoft canceled six games, closed two studios, and pre-announced February layoffs. Tom Henderson reported employees learned from Twitter because internal communication was "extremely limited."

Coverage focused on Prince of Persia getting axed after five years. The Halifax timing. The return-to-office mandate.

Everyone missed the actual story buried in November's earnings: Ubisoft breached its debt covenants September 30 and the accounting restatement that triggered it erased €314 million in EBITDA.

This isn't about game quality. This is about a company weeks from mandatory loan repayment that couldn't make it without selling a quarter of its crown jewels to a Chinese conglomerate. Five years, three studios, two restarts, and $80 million later—Prince of Persia wasn't killed by quality standards. It was killed by a balance sheet that finally caught up with a decade of mismanagement.

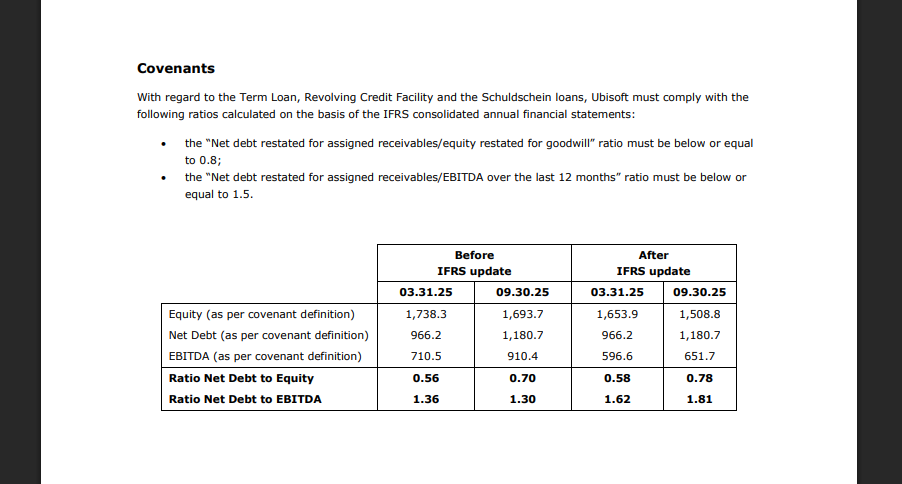

Page 19, Bottom Table

I pulled Ubisoft's H1 FY26 earnings PDF straight from their investor relations site. 54 pages. Most of it corporate speak about "portfolio optimization" and "Creative Houses building annual billionaire brands."

Fifty-four pages of vision statements about becoming a "leading platform company." Then page 19. Covenant compliance table at the bottom. The corporate equivalent of burying the diagnosis on page 19 of a medical report.

Before IFRS Restatement (as originally reported):

- Net Debt to EBITDA: 1.30

- Covenant limit: 1.50

- Status: Compliant

After IFRS Restatement (corrected):

- Net Debt to EBITDA: 1.81

- Covenant limit: 1.50

- Status: Breach

Page 19 of Ubisoft's H1 FY2025-26 earnings. The covenant breach is right there in black and white.

They missed the covenant by 20%. Not close. Not "approaching limits." Default trigger territory. The kind of miss that makes bankers start drafting asset seizure paperwork.

Bloomberg broke it November 21: "Ubisoft Entertainment SA said it will use money from a Tencent Holdings Ltd. investment to pay off debt after the video-game publisher breached a loan agreement because of its accounting practices."

Read that again. Not "market conditions." Not "challenging macroeconomic environment." Their own accounting practices. Ubisoft's books were so poorly kept that when new auditors showed up, €258.7M in EBITDA simply vanished.

Reuters added CFO Frédérick Duguet's explanation from the earnings call: new auditors hired July 2025 forced restatement of FY2025 partnership revenue. Two B2B deals where Ubisoft booked upfront commitments needed to be recognized over time instead of immediately.

The revision tanked EBITDA from €910.4M to €651.7M (€258.7M drop), while equity fell from €1.738B to €1.654B (€84M drop). Combined impact: €342.7M erased from the balance sheet—though the EBITDA component alone (€258.7M) was what triggered the covenant breach.

Not rounding error. €342.7 million is roughly what it costs to develop three AAA games. It's more than XDefiant's entire budget. It's the accounting equivalent of discovering the floor isn't where you thought it was—because someone moved it and didn't tell anyone.

What Happens When You Breach Covenants

TP ICAP Midcap analyst Corentin Marty told Reuters November 21: "The delay can be explained by the need to restate last year's accounts and, above all, to validate the Tencent deal (which may still have had to satisfy a few conditions) since a covenant on a credit line had been exceeded."

Standard covenant breach remedies banks can demand:

- Immediate repayment in full

- Penalty interest (typically 200-300 basis points over base rate)

- Asset seizure rights kicking in

- Operational control provisions activating

- Forced asset sales to cover exposure

Ubisoft avoided this because Tencent's €1.16B was closing. Bloomberg confirmed the company would use Tencent proceeds for "early repayment of around 286 million euros ($330 million) in outstanding loans."

Here's what keeps nagging me: €210M of that Term Loan was due the following month (December 2025, per the earnings doc). Ubisoft wasn't just managing covenant compliance. They were weeks from a mandatory repayment they likely couldn't make from operations.

The Tencent money didn't save Ubisoft from angry lenders. It saved them from insolvency.

And Yves Guillemot—the man who supposedly steers this ship—structured the bailout to keep his family in control while selling the company's most valuable franchises to the highest bidder. If that's visionary leadership, I'd hate to see what failure looks like.

The Auditor Switch Nobody Explained

July 2025: Ubisoft hires new auditors.

CFO Duguet's November 21 explanation: "newly appointed panel of auditors requiring a restatement of fiscal 2025 accounts related to revenue recognition of partnership deals."

Which partnerships? Ubisoft won't say. Bloomberg noted "improperly booked sales from a partnership" under IFRS. The H1 earnings doc mentions "utilization-based payment schedules" that should be "recognized under IFRS15 as revenues over utilization."

What they said: "Utilization-based payment schedules."

Translation: Ubisoft signed deals where clients pay based on actual usage/performance. Old auditors said "book it all now." New auditors said "book it as they use it."

That's not minor technical disagreement. That's fundamentally different accounting philosophy. The kind that makes a €258.7M difference.

So why did Ubisoft switch auditors mid-crisis? The November earnings don't say. French regulations require auditor rotation every six years for publicly traded companies, but timing matters. Did regulators force the change? Did old auditors resign over disagreements? Did Ubisoft fire them for asking too many questions?

Can't find documentation either way. Duguet explained the restatement but dodged who initiated the auditor change and why. Journalists didn't press. Analysts didn't follow up. Everyone moved on to the Tencent deal and forgot to ask how a €100+ billion company was booking revenue like a startup trying to juice metrics for Series B.

What's documented: New auditors immediately flagged revenue recognition problems severe enough to trigger covenant breaches. Either old auditors missed something major, or they saw it and Ubisoft ignored them. Neither scenario screams "functional financial controls." Both scenarios scream "leadership asleep at the wheel while the car headed for a cliff."

The Timeline Everyone Should Have Connected

Everyone covered January 21 as isolated announcement. Let me show you the sequence:

November 13, 2025 (7:45 PM CET): Ubisoft requests Euronext halt all trading minutes before scheduled earnings release. Press release: results "postponed to an unspecified future date." No explanation.

Stock and bond trading frozen. Shareholders completely in the dark.

November 14, 2025: Trading remains halted. Speculation runs wild—bankruptcy filing? Tencent deal collapsed? Accounting fraud discovered?

November 21, 2025 (9:00 AM CET): Trading resumes. Earnings released showing:

- FY2025 restatement erasing €314M+ in equity/EBITDA

- Covenant breach September 30

- €286M debt requiring immediate repayment via Tencent money

- Stock initially drops 6%, then rebounds 10% (per Reuters)

November 21 - December 2025: "Thorough review of content pipeline over December and January" (per January 21 announcement). This is when project cancellation decisions supposedly got made.

January 7, 2026: Halifax closure announced (20 days after December 18 unionization).

January 21, 2026: Six games canceled, Stockholm closed, February layoffs announced, employees learn via Twitter.

Exactly two months between covenant breach discovery and restructuring announcement.

Coincidence is for people who don't read earnings filings.

The Math Doesn't Work (Unless It's Desperation)

Ubisoft's stated cost plan: €100M savings by FY26-27.

What they announced January 21:

Prince of Persia: Sands of Time remake

- Announced 2020

- Handed to Pune studio

- Restarted at Montreal 2022

- Restarted AGAIN 2023

- Delayed to "early 2026" last year

- Canceled today

Industry standard for major AAA remakes: $50-80M development cost. Five years across three studios with two complete restarts? That's not development—that's a controlled demolition in slow motion. Ubisoft management watched $80+ million burn for half a decade and only found the fire extinguisher when the banks showed up.

The Prince of Persia team found out their five-year odyssey was over the same way customers learn about server shutdowns: social media. Years of crunch, restarts, studio transfers—all reduced to a press release timestamp. If there's a more efficient way to destroy developer morale while wasting shareholder money, Ubisoft hasn't found it yet. But give them time.

Three unannounced new IPs

Early stage but concepting/prototyping costs accumulate. Assuming 2-3 years pre-production each at $10-15M per project: another $30-45M turned into nothing. These weren't canceled games—they were canceled careers. Years of concept art, pitch decks, and prototype builds, all orphaned because leadership couldn't manage a balance sheet.

Halifax (71 employees) + Stockholm (~100 employees)

Canadian game developer salaries average $75-95K CAD (~$55-70K USD). Swedish rates similar. Call it $65K average loaded cost. That's ~$11M annual savings from headcount alone.

For context: Yves Guillemot's FY2024 compensation was €3.9M. The 171 employees losing their jobs between Halifax and Stockholm represent roughly three years of the CEO's salary. They get severance. He gets another year in the chair.

"Several" more studios restructured

Abu Dhabi, Redlynx (Helsinki), Massive mentioned. Numbers not disclosed. More bodies.

€200M additional cost reduction target by March 2028

Beyond the original €100M. Because the first round wasn't enough.

They're not optimizing. They're amputating.

And here's the question nobody asked: if quality concerns justified Prince of Persia's cancellation, why restart it twice before canceling? Why not kill it in 2022 after the first restart failed?

Guillemot's explanation from January 21: canceled games "do not meet enhanced quality and selective portfolio prioritization criteria."

The actual math buried in November financials: they breached covenants, needed emergency cash, and had to slash burn rate before lenders forced asset sales.

Prince of Persia didn't get canceled for quality. It got canceled because covenant breach math required cutting everything not generating immediate revenue.

Ubisoft spent five years and $80M+ on a remake that never shipped. In that same timeframe, Larian Studios made Baldur's Gate 3 with a smaller team. CD Projekt Red rebuilt Cyberpunk 2077 from disaster to acclaim. Hello Games turned No Man's Sky into a success story. Ubisoft watched a remake shuffle between three studios and two complete restarts, then blamed quality standards when the banks came calling.

The difference between those studios and Ubisoft: leadership that could make decisions and stick with them.

Halifax: The 20-Day Window

December 18, 2025: Halifax workers vote to unionize. 61 employees, 74% approval, 100% turnout. CWA Canada certifies it immediately.

January 7, 2026: Closure announced.

Game Developer asked Ubisoft directly: provide timeline showing when closure decision was made. Prove it predates unionization.

Ubisoft refused.

That refusal is the story. Companies facing union retaliation accusations don't refuse to provide exonerating evidence—they publish it immediately with a press release and a lawyer standing by. Board meeting minutes dated November would shut down the narrative instantly.

Ubisoft has that documentation if the decision predates December 18. They won't share it.

CWA Canada reported Ubisoft lawyers showed up to January 14 negotiations "woefully underprepared"—no financial documentation, no relocation options, no timeline proof. They promised documents by January 16.

Did Ubisoft provide them? CWA Canada's statement: they "had nothing to offer."

Cross-reference the covenant breach timeline. Ubisoft spent six months (June-December 2025) fighting Halifax unionization through multiple labor board hearings. They only dropped opposition when defeat became inevitable.

Twenty days later: studio closed.

If you plan to close a studio, why spend six months and legal fees fighting unionization there? Either leadership is so disorganized the left hand doesn't know what the right's doing, or the unionization itself changed the calculation.

Given Ubisoft's documented history—2023-2024 French strikes, Barcelona lawsuit over RTO mandate, Solidaires Informatique demanding Guillemot face harassment complicity charges—which explanation fits?

The Tencent Bailout Structure

March 27, 2025: Ubisoft announces Tencent will invest €1.16B for 26.32% of Vantage Studios—subsidiary housing Assassin's Creed, Far Cry, Rainbow Six.

Deal structure protects Guillemot family voting control (they retain 20%+), puts Yves' son Charlie as co-CEO, and avoids triggering French mandatory buyout laws (30% threshold).

Minority shareholder AJ Investments immediately called it "deeply flawed, structured to bypass mandatory public offer rules, and designed to entrench Guillemot family control."

Where does the money actually go?

November 21 earnings: "€286 million outstanding principal" goes immediately to repay Term Loan and Schuldschein loans—the exact debts where they breached covenants.

Remainder supports "selected investment opportunities" and "ongoing reorganization efforts"—corporate language for restructuring costs and severance packages.

Tencent's not investing in Ubisoft's future. They're acquiring Assassin's Creed, Far Cry, and Rainbow Six at bankruptcy-adjacent prices while the Guillemot family uses other people's money to cover their own management failures.

The deal structure bypassed French mandatory buyout laws while protecting Guillemot family control. Regular shareholders got diluted when the stock crashed 24% on announcement day. It's down another 15%+ since. Anyone who bought Ubisoft stock before 2024 has lost roughly 85% of their investment.

Yves remains CEO despite an 85% value collapse. Charlie gets co-chief title despite zero public track record justifying the position. The family keeps voting control despite presiding over convicted executives, thousands of layoffs, and a covenant breach that required emergency Chinese intervention.

At Rockstar, the Houser brothers built GTA and Red Dead Redemption. At CD Projekt Red, the Iwinskis built The Witcher and Cyberpunk. At Ubisoft, the Guillemots built... a structure that ensures they keep control while everyone else pays for their failures.

The Guillemots get paid. Shareholders get diluted. Employees get Twitter announcements.

What Employees Learned Via Twitter

Tom Henderson's reporting confirmed it: "Many Ubisoft employees found out about today's news via media reports. Internal communication about the restructuring across the company was extremely limited."

People who spent years on Prince of Persia learned it was canceled when Kotaku tweeted.

People working on three unannounced IPs—projects they'd concepted, pitched, prototyped—found out those games would never ship because IGN posted the announcement.

That's not communication failure. That's institutional contempt dressed up as operational secrecy. It's leadership saying "you don't matter enough for a direct conversation."

And it gets worse. Ubisoft pre-announced February 12 layoffs—no numbers, no locations, just "more cuts coming in three weeks, we'll tell you if it's you later."

If you work at Ubisoft right now: you know layoffs are happening. You don't know if you're getting fired. And you've been told return to office five days a week starts immediately. Come back to the building so we can fire you in person—assuming we remember to tell you before Kotaku does.

That's legal under employment law in most jurisdictions. It's also the kind of management style that makes employees update their resumes the moment the announcement drops. Ubisoft isn't just losing headcount in these layoffs—they're losing everyone competent enough to find work elsewhere. The ones who stay will be the ones who can't leave. That's not a workforce. That's a hostage situation with health benefits.

Why Governance Failed Before the Covenant Breach

Yves Guillemot has been CEO for thirty-seven years. Longer than most developers have been alive. Longer than the PlayStation brand has existed. Longer than the entire history of 3D gaming.

In that time: three convicted executives, 2,900+ layoffs, a covenant breach, and a bailout structured to protect family control. That's the tenure.

The 2020 harassment scandal revealed institutional tolerance for executive misconduct when it delivered revenue. HR leadership allegedly told managers "Yves is OK with toxic management, as long as the results exceed toxicity" (per Libération's investigation of 20 employee testimonies). Three executives were convicted in July 2025. Guillemot never testified. He remained CEO.

That pattern—protecting profitable dysfunction rather than addressing root causes—preceded the financial crisis.

By 2024, warning signs were everywhere: debt approaching market cap, multiple game underperformances, 1,500+ layoffs. French unions demanded leadership change. Employees struck over office mandates and compensation. Halifax workers unionized explicitly fearing closures.

Leadership's response: structure a Tencent deal protecting Guillemot family voting control (20%+ retained) while diluting minority shareholders. Put Charlie Guillemot (Yves' son) as co-CEO of Vantage Studios holding the company's three most valuable franchises.

When the covenant breach hit September 30, governance structures weren't designed for accountability—they were designed to ensure the Guillemot family stayed in charge no matter how badly they performed. And by that metric, the structures worked perfectly.

The January restructuring—canceling projects via Twitter, refusing Halifax documentation, pre-announcing layoffs with no details—reflects that same priority: protect leadership position while cutting costs to satisfy lenders. Junior developers get fired via social media. Convicted executives got suspended sentences. The CEO who oversaw it all gets another year in the chair.

Whether Guillemot survives long-term or this accelerates Tencent acquisition remains unclear. What's documented: thirty-seven years of tenure, harassment scandal management never testified at, stock collapse under his watch, covenant breach requiring emergency intervention, and deal structure protecting his family's control above shareholder value.

The only accountability in this story is landing on employees. Executives get parachutes. Shareholders get diluted. Workers get three weeks of uncertainty followed by Twitter announcements.

Someone made €80 million disappear for five years on a remake nobody could finish. Someone signed off on booking revenue that would later require restatement. Someone fought Halifax unionization for six months before closing the studio. Those someones are still employed. The developers who actually made games? Many of them aren't.

February 12: The Waiting Game

Three weeks advance notice of layoffs. No details.

If you're at Ubisoft, you know cuts are coming. You don't know if it's you. And you've been told return to office five days a week starts now.

Maybe this is positioning for severance negotiations. Maybe it's HR finalizing packages. Maybe it's legal review.

Or maybe it's three weeks of employees updating LinkedIn, having quiet conversations with recruiters, watching which meetings they're suddenly excluded from.

Legal? Yes. Thoughtful? Debatable. Cruel? Draw your own conclusions.

Where This Ends (Three Scenarios)

Best case

Tencent money stabilizes finances through FY27. Assassin's Creed and Far Cry releases hit big. Company survives as Tencent-controlled subsidiary. Hundreds lose jobs but core franchises continue.

Realistic case

Cost cuts aren't enough. New releases underperform again. Tencent gradually increases to majority stake. Guillemot exits with golden parachute. More studios close. IP sold piecemeal to EA, Microsoft, Sony.

Worst case

FY27 projections miss. Lenders lose patience. Tencent walks or renegotiates at fire-sale valuation. Bankruptcy filing. Asset liquidation. Assassin's Creed to Tencent, Far Cry to Microsoft, Rainbow Six to EA, everything else shuttered.

I'm not predicting which. But the covenant breach—revealed two months late, buried on page 19, requiring emergency billion-dollar intervention—suggests leadership lost control somewhere around 2023 and hasn't regained it.

The Uncomfortable Truths

1. January 21 wasn't "portfolio optimization." It was panic cost-cutting to avoid default.

2. Halifax closure twenty days post-union might not be provable retaliation in court. But Ubisoft refusing to provide documentation proving innocence speaks volumes.

3. Employees learning via Twitter about years-long projects getting canceled isn't communication failure. It's leadership valuing press coverage over people.

4. "Strengthening Ubisoft's financial position" via Tencent deal means one thing: Using Chinese money to pay off European lenders before they force liquidation, while ensuring the family that caused the crisis keeps voting control. It's not a turnaround strategy. It's an exit strategy that hasn't finished exiting.

5. Yves Guillemot protected family control while presiding over: Covenant breach. Thousands of layoffs. Shareholder value destruction. Convicted executives. Six canceled games announced via social media. A unionized studio closed 20 days after certification. A son elevated to co-CEO despite no obvious qualification except surname.

The man's had the same job for thirty-seven years. Three different console generations. Five different FIFA deals. Zero accountability. At some point the pattern stops being coincidence and becomes governance failure with a corner office.

6. The industry is watching. Every studio that considered unionizing just watched Halifax get closed after winning. Every developer thinking about staying at Ubisoft just watched colleagues learn about project cancellations from Twitter. Every shareholder just learned their equity was diluted to cover debts management accumulated. If Ubisoft wanted to write a masterclass in destroying trust across every stakeholder group simultaneously, this would be the curriculum.

Sources & Methodology

Financial documents reviewed:

- Ubisoft H1 FY2025-26 Earnings Report (November 21, 2025) - full 54-page PDF

- Ubisoft H1 FY2025-26 Investor Presentation (November 21, 2025) - slideshow

- Covenant breach table: pg. 19 of earnings PDF

News sources:

- Bloomberg (November 21, 2025): "Ubisoft to Tap Tencent Money to Pay Off Breached Loan Agreement"

- Reuters (November 21, 2025): "Ubisoft flags strong Q2 bookings in a report delayed by debt covenant breach"

- Game File (November 21, 2025): "Speculation around Ubisoft earnings delay proves unfounded"

- Tom Henderson/Insider Gaming (January 21, 2026): internal communication reporting

- VGC, Variety, PC Gamer (January 21, 2026): announcement coverage

Analyst sources:

- Corentin Marty, TP ICAP Midcap (via Reuters, November 21)

- AInvest.com analysis (November 21): "Ubisoft's Governance and Financial Stability Risks"

What I couldn't verify:

- Which specific partnerships triggered the restatement (Ubisoft won't disclose)

- Whether Halifax closure was retaliation (timeline damning, documentation missing, can't prove intent)

- Exact development costs for canceled games (industry estimates only)

- February 12 layoff numbers (not yet disclosed)

Reporting notes: I wasn't at Ubisoft. Didn't attend earnings calls or briefings. Everything here comes from public filings, financial documents, and reporting by outlets with access.

The covenant breach is documented fact (stated in earnings). The timeline is documented fact (public filings). The employee communication failure is confirmed reporting (Tom Henderson).

What seems clear: Ubisoft breached covenants, needed emergency intervention, and is now desperately cutting costs while leadership protects their positions.

Employees deserved better than Twitter announcements.

If you work at Ubisoft and have documentation contradicting any of this—especially Halifax closure timeline or covenant breach details—reach out at support@gamehazards.com. Will update with verified corrections.